The Five Best Mobile App Payment Solutions For 2021, part 3 - Square vs PayU

- mobile payments

- fintech

- flutter

- business

- technical

Introduction

Hi, I’m Tomasz Michlewski from AllBright.io. Welcome to the third part of “The Five Best Mobile App Payment Solutions For 2021”.

In part 1, I described what a payment processor is and included a short description of the best payment gateway providers, according to our experience. That instalment ended with a brief comparison of all five solutions.

Part 2 then laid out the details of these three solutions: Braintree, Stripe, and Mollie.

In this third part, I will focus on the other solutions Allbright recommends, namely Square and PayU.

Keeping to the structure, as seen in part 2, this article begins by characterising both suppliers across three categories:

- Geographic availability

- Costs and payment methods

- Technological constraints

Finally, we present the pros and cons for each solution.

So, let’s move on to the first payment processor, Square.

Square

Square is a US company that provides the highest quality payment gateways for mobile applications to businesses of all kinds. Square continually evolves according to the market’s needs. A case in point: Square responded rapidly to COVID-19 restrictions by offering vendors new solutions. These included On-Demand Delivery, made available alongside Square Online, and combined with flexible payment terms for the duration of the pandemic countermeasures. They also developed a user-friendly application which helped small businesses get financial support during the crisis. You can read more about their vendors’ stories here.

Geographic availability

As mentioned before, the company focuses on providing its solution within the US, but are looking to expand to other regions. The currently supported countries are: US, Canada, Japan, Australia, the United Kingdom, Republic of Ireland, France and Spain. Transactions outside these countries are not supported.

Square does not support cross-border card payments. Card transactions attempted while outside the country the account was activated do not work, but you can receive funds while travelling abroad.

A complication to consider is, if your software product is used in more than one country, you will need:

- A Square account for each country

- A unique email address for each account

- Separate identity verification for each account

Payments and usage fees

Fees for all single transactions passing through Square’s SDK are set at a fixed rate of 2.9% + 30¢

When it comes to payment methods, there are limited options: credit/debit cards, Square gift cards, Apple Pay and Google Pay.

Integration capabilities

Now let’s move on to the best part of Square’s system and the main reason why it’s on our list. Square supplies a ready to use UI and it looks like this:

Square supports implementations for:

And Square takes good care of the humble developer too:

- Full support for both native and cross-platform technologies

- Both customisable and ready to implement UIs are supported

- Comprehensive documentation and implementation guides are available

Of all the payment processors we recommend, Square is top in terms of integration.

Official support for Flutter and React Native means that you do not have to decide on a native SDK full of legacy; you can use a more modern solution. As a developer, this is all you could ask for! They understand our needs and we find it easy to recommend them.

Pros

- Excellent coverage of the United States

- SDK provides wide range of in-app technical solutions

- Simple fee structure

Cons

- Cross-border payments not supported

- Complicated system for multiple locations

- Limited range of payment methods

PayU

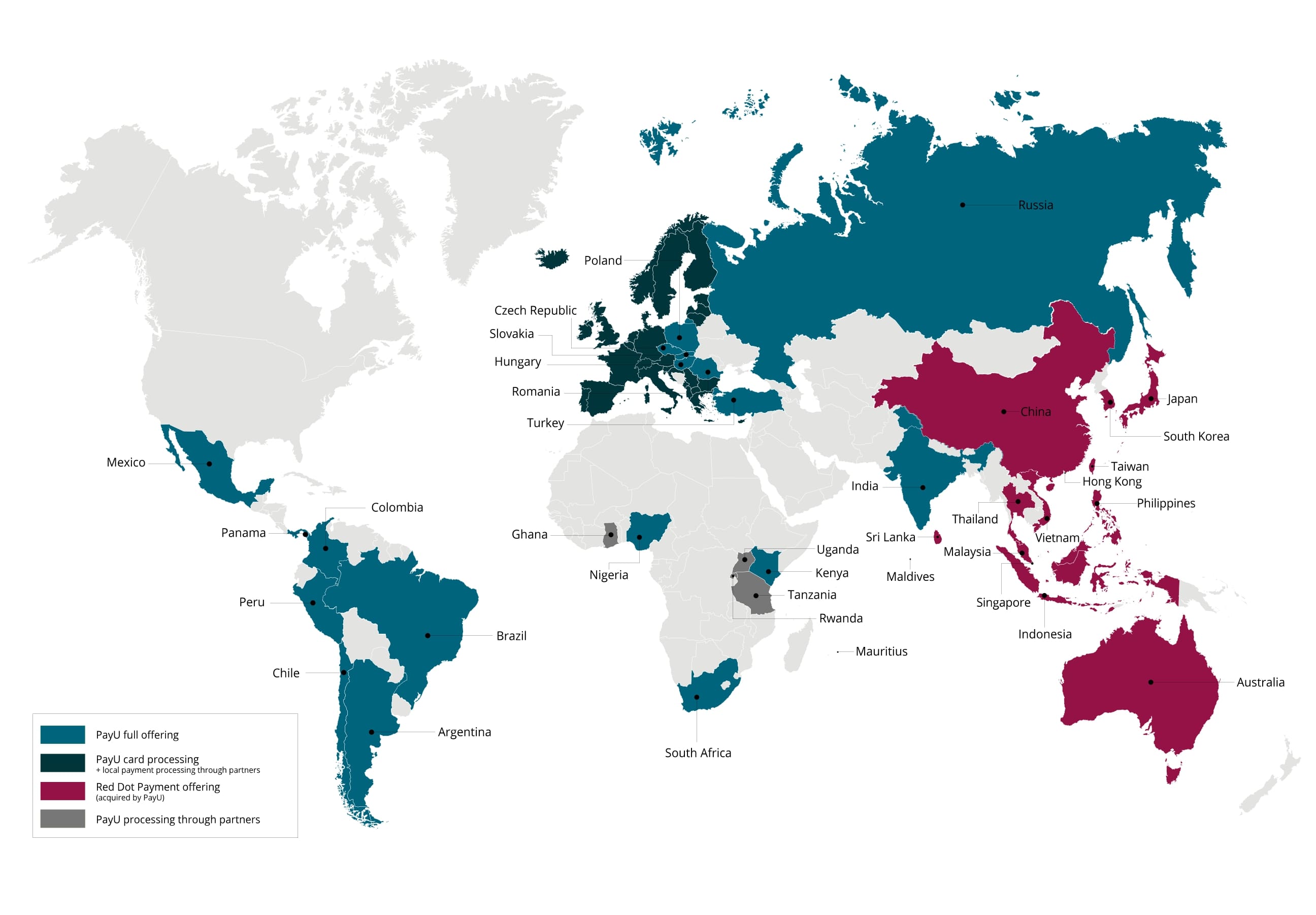

Whereas Square has a strong base in US markets, let us now turn to a company that is explicitly geared towards the East Asia market. PayU is a Polish company whose priority is to provide the best possible support for local payments. They hold licenses from national banks and local regulators and, thanks to this, their clients can offer a wide range of local payment methods.

Geographic availability

PayU is available in the following countries: South Africa, Nigeria, Kenya, Brazil, Argentina, Chile, Colombia, Mexico, Panama, Peru, Czech Republic, Poland, Romania, Russia, Turkey, India. However, if you are prioritising Western Europe, don’t give up yet, since PayU can also support card processing in those countries.

Payments and usage fees

In the case of PayU, the issue of price is a bit more complicated because it varies by the region. We can give two countries as examples: Poland, PayU’s home country; and India, where PayU is the undisputed market leader.

As of today, late 2022, PayU offers a discount for the Polish market, which is going to last to December 15.

Thus, the price for a single transaction using PayU, Blik, or online transfer is a flat 1.2% (standard fee: 2.3%). For payment cards, Google pay and Apple pay, the price for a single transaction is 1.2% + 0.3 PLN (standard price 2.3%).

Fortunately, in the case of India, there is only a charge per transaction.

PayU charges flat 2% + GST (18%) for each transaction. Example:

Customer Paid: ₹ 100

Transaction charge: ₹ 2

GST: ₹ 0.36

Amount settled: 100 - 2 - 0.36 = ₹ 97.64

The situation is different, however, with American Express and Diners Cards. The service fee is 3% + India’s GST (Goods & Services Tax) for international transactions & EMI (Equated Monthly Instalments) payment options. There is also a set-up fee along with Annual Maintenance Charges (AMC). The service fee is 3% + ₹6 for every transaction.

What is GST? It is an indirect tax that has replaced other taxes and fees applied by central and state administrations.

PayU focuses on providing the best support at local level for each supported country, so their payment methods include many local banks and transfer methods.

Here is a very extensive list of the supported methods. Default payment methods for smartphones are available regardless of the region, meaning that Google Pay and Apple Pay are accessible everywhere.

Integration capabilities

PayU supports implementations for:

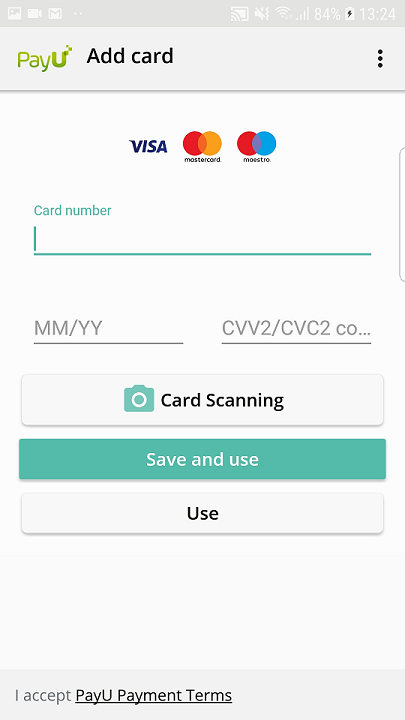

In this case, there’s no ready-to-use UI available to drop into an application. However, PayU does provide an Android and an iOS SDK, which handles all the payment problems and assures safe use. Implementation is made easier as PayU includes access to extensive guides and documentation, and also a series of tutorials on YouTube, which show how to implement their SDK in the example applications from beginning to end. Not bad! However, this time cross-platform technologies are entirely unsupported, so when choosing PayU, we stick with the native SDK.

Pros

- Comprehensive resources for developers

- Good support for local markets

Cons

- No support for cross-platform technology

- Complicated fee structure

Summary

Square and PayU are payment gateway providers focused on local markets. They do not target international markets but focus on delivering the highest quality in specific parts of the world. Thanks to their niche focus, they can apply a more individual approach.

In summary, Square is a company that focuses on new solutions, officially supporting technologies such as Flutter and React Native. The company strives to provide its customers with the most transparent cost structure possible. Unfortunately, the number of available payment methods is minimal, but this is because they restrict themselves to solutions that are well-known to their customers. Square specialises in solutions for the English-speaking market and is unrivalled in its areas of operation.

PayU, unlike Square, is not so progressive. They realise that a large number of users who use their services are not so well versed in technology. Instead of targeting the latest solutions, they focus their efforts on providing their customers with something familiar. Their offer of local banks is unrivalled, which makes their clients very fond of PayU. Developers, however, cannot count on as much facilitation as with Square.

Both have their pros and cons, and it’s hard to say which approach is better. Square and PayU, however, both offer services at the highest level. Which to choose depends on individual business requirements and the project.

| Geographic availability | PayU | Square |

|---|---|---|

| USA | — | ● |

| CANADA | — | ● |

| AUSTRALIA | — | ● |

| JAPAN | — | ● |

| NORTH AMERICA | (Mexico) | — |

| SOUTH AMERICA | — | — |

| EASTERN EUROPE | ● | (— ) |

| CENTRAL EUROPE | ● | — |

| WESTERN EUROPE | — | ● |

| ASIA | ● | — |

| Default payment methods for mobile applications | PayU | Square |

|---|---|---|

| GOOGLE PAY | ● | ● |

| APPLE PAY | ● | ● |

| Fees | PayU | Square |

|---|---|---|

| EU CARDS | 1.2% - 2.3% + 0.3PLN | 2.9% + 30¢ |

| NON EU CARDS | — | 2.9% + €0.25 |

| AMERICA EXPRESS | N/A | N/A |

| REGISTRATION | yes | — |

| Technology | Braintree | Stripe |

|---|---|---|

| ANDROID | ● | ●●● |

| IOS | ● | ●●● |

| FLUTTER | — | ●●● |

And that’s it! I hope by now you have a better idea of which solution is best for you, or at least you are slightly better informed as to what is out there. If you need specialists in the field of building mobile applications, or the implementation of payment processors in a mobile app, please contact us on contact@allbright.io.