The Five Best Mobile App Payment Solutions For 2021, Part 2 - Braintree vs Mollie vs Stripe

- mobile payments

- fintech

- flutter

- business

- technical

Introduction

Hi, I’m Tomasz Michlewski from AllBright.io. Welcome to the second part of “The Five Best Mobile App Payment Solutions For 2021”.

In the first part of this article series, we discussed what a payment processor is and briefly characterised and compared what, in our opinion, the best solutions for mobile payments are. In this article, we will take a closer look at solutions whose scale of operation could be called international i.e. available in most parts of the world. Part Three presents two regionally-specific payment solutions.

The companies that appear in this article are Braintree, Stripe and Mollie.

Each solution is reviewed according to these three criteria:

- Geographic availability

- Costs and payment methods

- Technological constraints

Finally, we present the pros and cons for each solution.

So let’s move on to the first payment processor on the list.

Braintree

When we asked for their view on the subject, many people replied, “Braintree is the best payment gateway in the world.”

It’s hard to disagree with them, especially when we are talking about smooth implementation in a mobile application. But first, an introduction to this company.

In 2013, PayPal acquired Braintree for $800 million. Since then, the system has grown extensively and is used by companies such as Airbnb, Uber, and Hotel Tonight.

Geographic availability

Braintree is available in all European countries, in the United States of America, Canada, Australia, Singapore, China including Hong Kong, Malaysia and New Zealand.

Availability in these specific countries does not mean that users won’t be able to make a payment if they are in a country that Braintree doesn’t support. They will just need to make sure that a company’s headquarters and bank are located in a supported country. You can read more about it in Braintree’s FAQs here.

Payments and usage fees

As of August 2022, Braintree charges a standard rate for each card transaction: 1.9% + €0.30. The exceptions to this are American Express transactions, with a charge of 2.9% + €0.30.

There is an additional fee, which is in the case of a chargeback i.e. the customer disputes a payment. In this case, a €30 fee will be charged for each chargeback event.

The good news is that there are no implementation costs and no subscription fee. However, the company stresses that rates may change in the future, so I would advise you to check the current prices on their website.

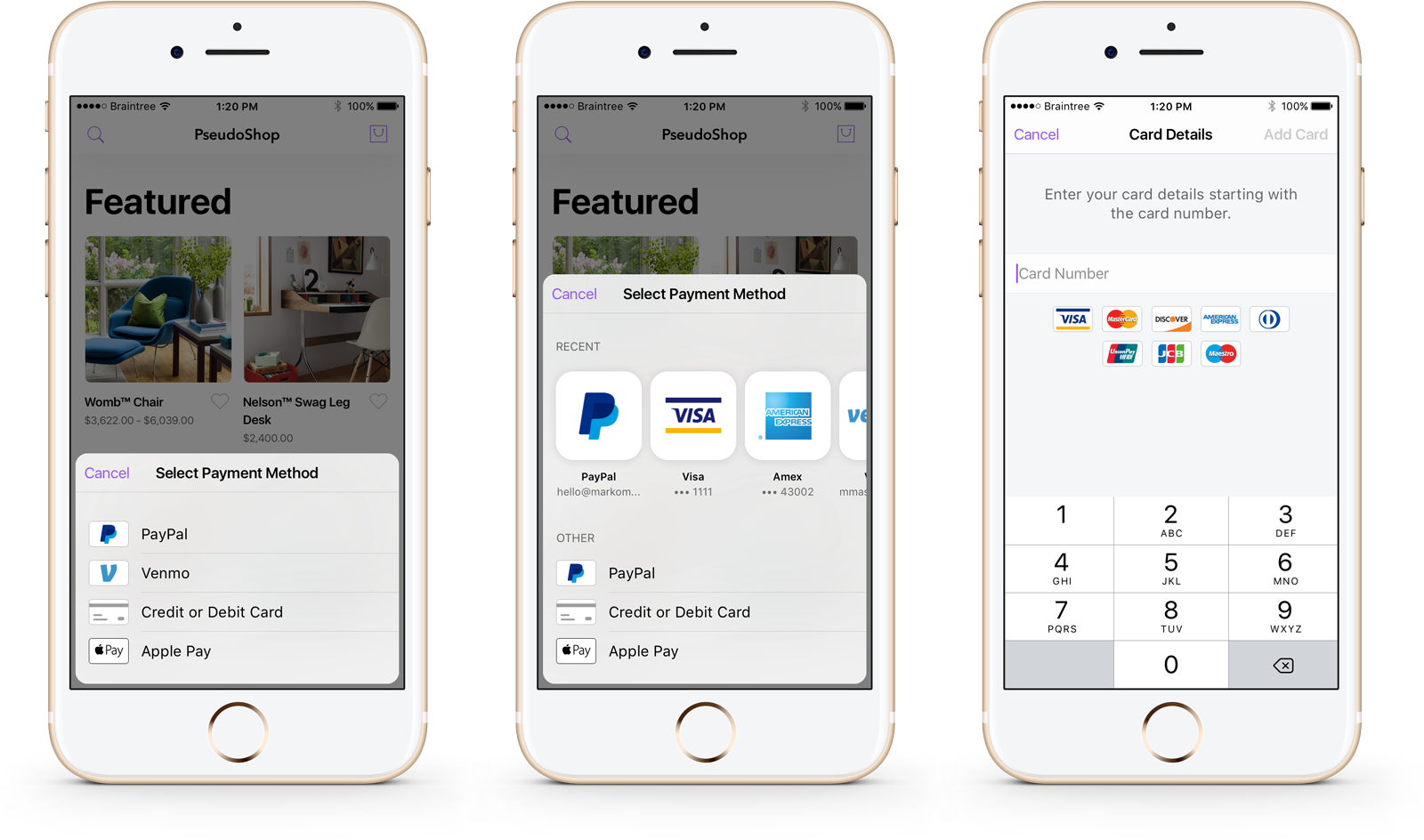

The payment methods available via Braintree are shown in this table:

| Credit /debit cards | E-wallets | Local options |

|---|---|---|

| Mastercard | Apple Pay | Bancontact |

| Visa | Samsung Pay | eps |

| UnionPay | Google Pay | ACH Direct Debit |

| Amex | PayPal | Klama Pay Now (Sofort) |

| Discover | Visa Checkout | giropay |

| Diners | Masterpass | iDEAL |

| JCB | Venmo | SEPA Direct Debit |

| Maestro | Amex | MyBank |

| — | Express Checkout | — |

Integration capabilities

Braintree supports implementation for:

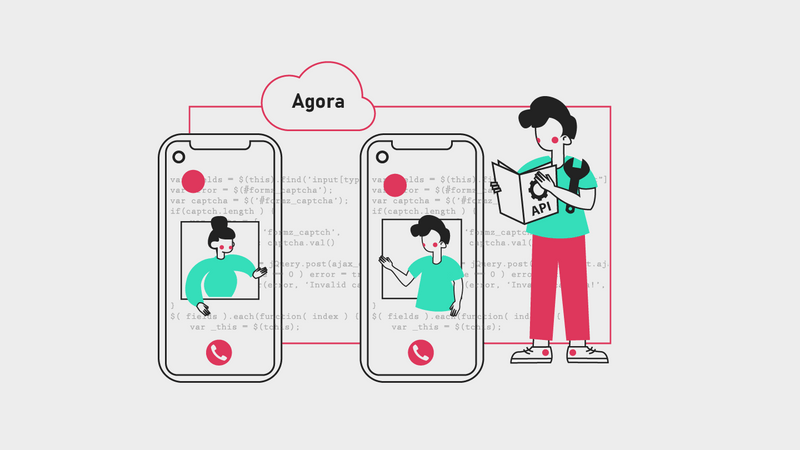

Braintree provides detailed resources and tools for developers and offers very clear integration guides. It is the most straightforward payment processor to integrate of all on this list.

A notable feature of Braintree’s integration is the ready-to-use drop-in UI that you can implement in your application.

For those who prefer cross-platform technology, while Braintree itself does not provide its own solution, there is a range of high-quality third-party packages built and supported by the developer community. Most functions like a drop-in-UI can be implanted in a Flutter app using libraries such as flutter_braintree and braintree_payment. That is why, despite the lack of official support, we still recommend Flutter as a framework for a mobile application using Braintree.

Pros

- Affordable service costs

- Ready-to-use drop-in UI

- Comprehensive resources for developers

Cons

- No cross-platform support – requires a third-party solution

Stripe

As one of the largest global payment processors focusing on supporting developers in particular, Stripe had to be included in our list.

They offer convenient and, at the same time, utterly secure, integration of mobile payments.

The system is trusted by companies in a wide range of sectors, across ecommerce and retail, B2B platforms, software as a service, B2C marketplaces and non-profit organisations. Its clients include Amazon, Booking.com, Kickstarter, OpenTable, Shopify, UnderArmour, Wish and Xero.

Geographic availability

Stripe is available in the following countries: Australia, Belgium, Brazil, Bulgaria, Canada, Cyprus, Estonia, Finland, France, Germany, Hong Kong, India, Ireland, Italy, Japan, Luxembourg, Malaysia, Malta, Mexico, Netherlands, New Zealand, Norway, Portugal, Singapore, Sweden, Switzerland, the United Kingdom, the United States… and the list goes on and on.

Kind of impressive, isn’t it?

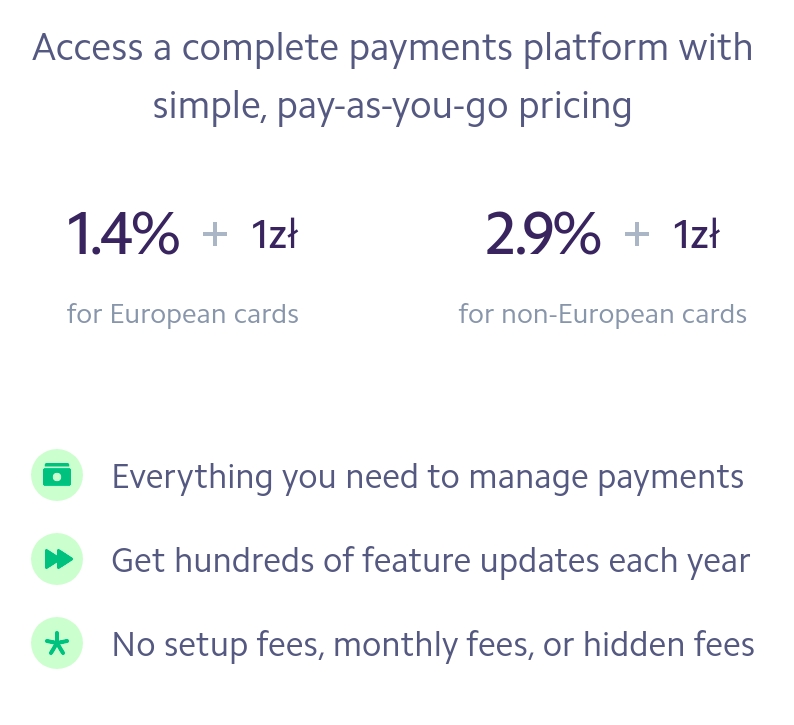

Payments and usage fees

Stripe’s fees vary by region. If you use a European credit or debit card, then the cost for each transaction is 1.4% + €0.25. For non-European cards, it is 2.9% + €0.25. There are no setup or subscription fees.

As for the available payment methods, they are as shown in this table:

| Credit /debit cards | E-wallets | Local options |

|---|---|---|

| Mastercard | Apple Pay | WeChat Pay |

| Visa | Microsoft Pay | ACH Debit |

| Discover | Google Pay | ACH Credit Transfer |

| American Express | Alipay | iDEAL |

| JCB | Visa Checkout | Bancontact |

| UnionPay | Amex Express Checkout | SEPA Direct Debit |

| Diners | Masterpass by Mastercard | EPS |

| — | WeChat Pay | Giropay |

| — | — | P24 BETA |

| — | — | SOFORT |

Integration capabilities

Stripe supports implementation for:

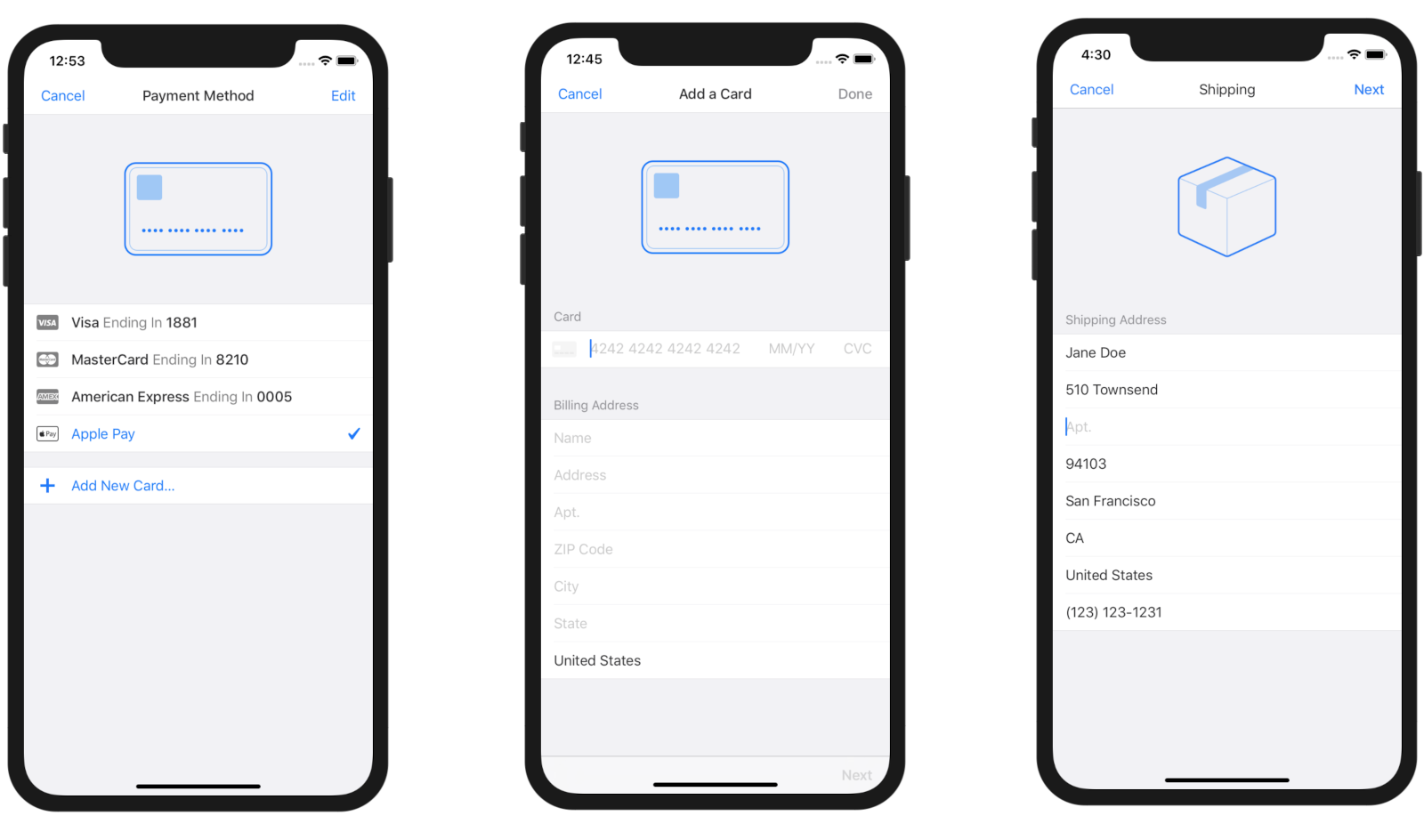

Stripe offers extensive documentation and implementation guides and also offers a ready-to-use UI that you can implement in your application. However, as per our experience, it is worth allowing generous implementation time. It is still justifiably second on our list of recommendations.

As with Braintree, Stripe does not officially support cross platform technologies like Flutter. Again, the developer community makes every effort to ensure that implementation can also be carried out with this framework.

Using libraries such as stripe_sdk and stripe_payment, we can create an application that uses Stripe as a payment gateway, where the code is shared by all platforms.

Pros

- Comprehensive resources for developers

- Ready-to-use UI

Cons

- No official support for cross-platform, but developer community provides rich libraries that wrap the Stripe software developer kit

Mollie

Mollie is a huge player with hundreds of easy-to-integrate plugins and packages. As they themselves say: over 90,000 businesses, including Acer, UNICEF, and Dyson, trust them for a reason. So let’s take a look at this giant.

Geographic availability

It would probably be easier to find a country that Mollie does not support. So let’s limit ourselves more generally to their regional areas of operation:

- North America

- Oceania i.e. Central and South Pacific Ocean

- Caribbean

- Europe

Some of the payment methods that Mollie integrates with are region-specific. For example, Postepay is only available in Italy, and Przelewy24 is only available in Poland.

Payments and usage fees

Once again, we return to the system where we pay only for single transactions. Mollie does not have a flat rate for all available payment methods. There are no minimum costs, no lock-in contracts, no hidden fees. Their fee structure is listed on their website here.

The standard rate for debit cards is €0.25 + 1.8% for EU countries and 2.8% for those outside Europe.

Apple Pay and PayPal transactions are supported, but not Google Pay!

| Credit /debit cards | E-wallets | Local options |

|---|---|---|

| Mastercard | Apple Pay | Przelewy24 |

| Visa | PayPal | iDeal |

| Maestro | — | Giropay |

| — | — | Eps |

| — | — | Cartes Bancaires |

| — | — | KBC/CBC Payment |

| — | — | Ing Home'Pay |

| — | — | Belfius Pay Button |

| — | — | Klarna |

| — | — | Sepa Direct Debit |

Integration capabilities

Integration with Mollie is not complicated, but there are some complications to watch out for.

One weakness is the lack of detailed information about security measures. They only stress what should be done so that your application won’t be rejected on Google Play or the Apple App Store. Their method of storing API keys in your app is insecure, so you’ll need to create a script on the server that your application can call to create an application payment.

Another thing to watch out for is that when making a payment with Mollie, the app must open a page in your native browser and it cannot open it in an in-app browser view. If the payment is made with a bank’s own application installed on a user’s phone, they will be redirected to the Mollie application. The user will then have to return to the banking app after payment is processed (or cancelled), meaning they have to interact with the app to complete the request. That’s one extra step for the user to process.

Here’s a comprehensive guide on how to implement Mollie in your mobile application.

Mollie supports implementation for:

Mollie, like the companies described above, also does not support cross-platform technology. In this case, the developer community is still working on implementing the native Mollie SDK into Flutter. As of November 2022 the library is not yet at version 1.0.0, which means that its creators do not consider it to be stable, or that it lacks the required functionality. That is why we advise sticking to the native SDK here.

Pros

- Global coverage

- Hundreds of easy-to-integrate plugins and packages

- Simple fee structure

Cons

- Clunky payment execution

- No Google Pay

Summary

Braintree, Stripe or Mollie? Each offers high quality services. Let’s go through the most important aspects together.

In terms of geographic accessibility, all three systems offer support in most countries of the world. That is why if your mobile application focuses on the largest world markets, such as Europe or the USA, then you can safely choose any of them. If you are also interested in the widest reach, including markets such as the Caribbean, then Mollie is your best option.

The next criterion was cost of service for the available payment methods. Here the services differ and it is worth considering who the customers of your mobile application are. For example, Stripe offers the best prices for transactions with EU payment cards, while Braintree has a price for non-EU cards that is on average 50% lower than the competition. Mollie, on the other hand, is in the middle when it comes to costs, charging a slightly lower percentage than Stripe for non-EU cards, but a little more for EU cards. On the other hand, it offers a more limited range of payment methods and does not support Google Pay, which is a major disadvantage for Android applications, putting Mollie far behind the competition. Simply put, if your clients will be mainly EU-based, then Stripe wins; if not, then Braintree is the no-brainer.

When each payment gateway was compared according to technological capability and ease of implementation in the mobile application, the winners are Stripe and Braintree - with a slight advantage for Braintree. Both offer smooth implementation and a ready-to-use UI. As a developer, I can say personally that I prefer Braintree because the implementation process is faster and more predictable than Stripe.

For a quick summary of the key features and characteristics of these providers, such as where a given service is available, what are the costs, or what forms of payment it supports, please see the table below.

| Geographic availability | Braintree | Stripe | Square |

|---|---|---|---|

| USA | ● | ● | ● |

| CANADA | ● | ● | ● |

| AUSTRALIA | ● | ● | ● |

| JAPAN | — | ● | ● |

| NORTH AMERICA | — | ● | — |

| SOUTH AMERICA | — | ● | — |

| EASTERN EUROPE | ● | — | — |

| CENTRAL EUROPE | ● | — | — |

| WESTERN EUROPE | ● | ● | (UK & IRL) |

| ASIA | ● | ● | — |

| Default payment methods for mobile applications | Braintree | Stripe | Square |

|---|---|---|---|

| GOOGLE PAY | ● | ● | ● |

| APPLE PAY | ● | ● | ● |

| Fees | Braintree | Stripe | Square |

|---|---|---|---|

| EU CARDS | 1.9% + €0.30 | 1.4% + €0.25 | 2.9% + 30¢ |

| NON EU CARDS | 1.9% + €0.30 | 2.9% + €0.25 | 2.9% + 30¢ |

| AMERICA EXPRESS | 2.9% + €0.30 | 2.9% + €0.25 | N/A |

| REGISTRATION | — | — | — |

| Technology | Braintree | Stripe | Square |

|---|---|---|---|

| ANDROID | ●●● | ●● | ●●● |

| IOS | ●●● | ●● | ●●● |

| FLUTTER | ●● | ●● | ●●● |

And that’s it! I hope by now you have a better idea of which solution is best for you. Remember that this is not over yes, because in the third part of the series we compare two more payment gateway providers - Square and PayU, which offer services targeted at more specific markets. link

If you need specialists in the field of building mobile applications or the implementation of payment processors in a mobile app, please contact us at contact@allbright.io.